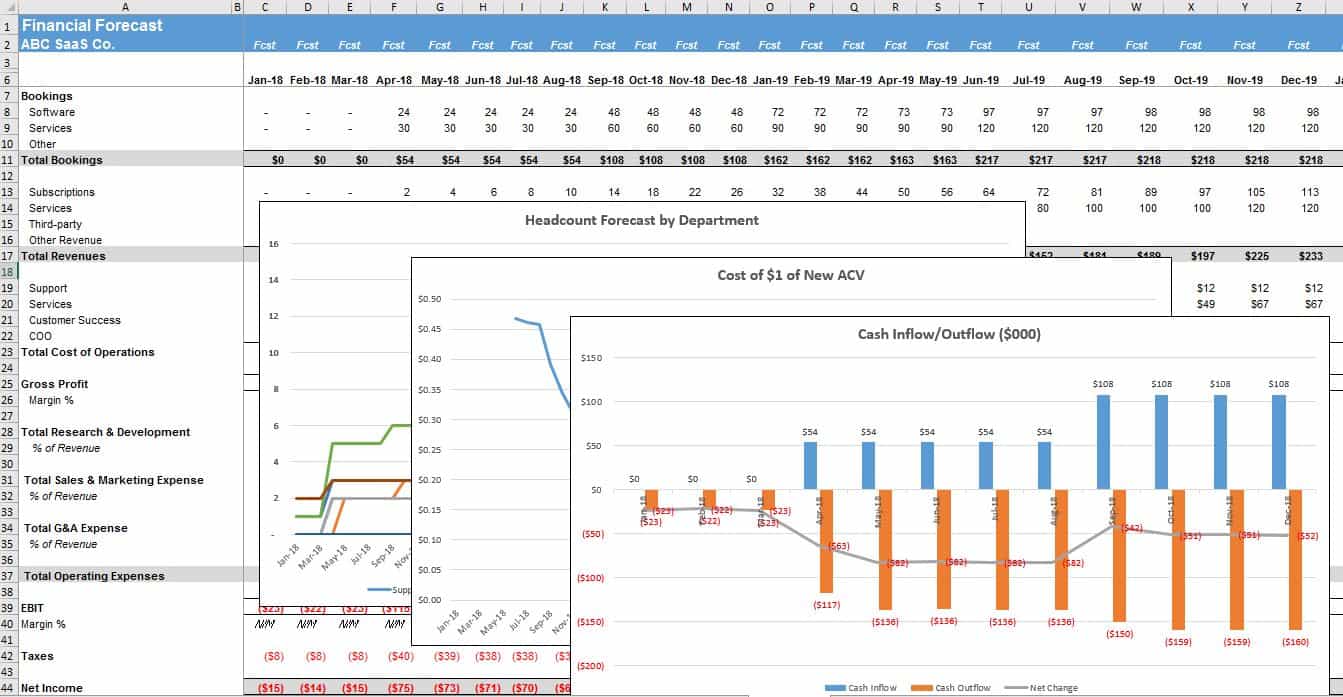

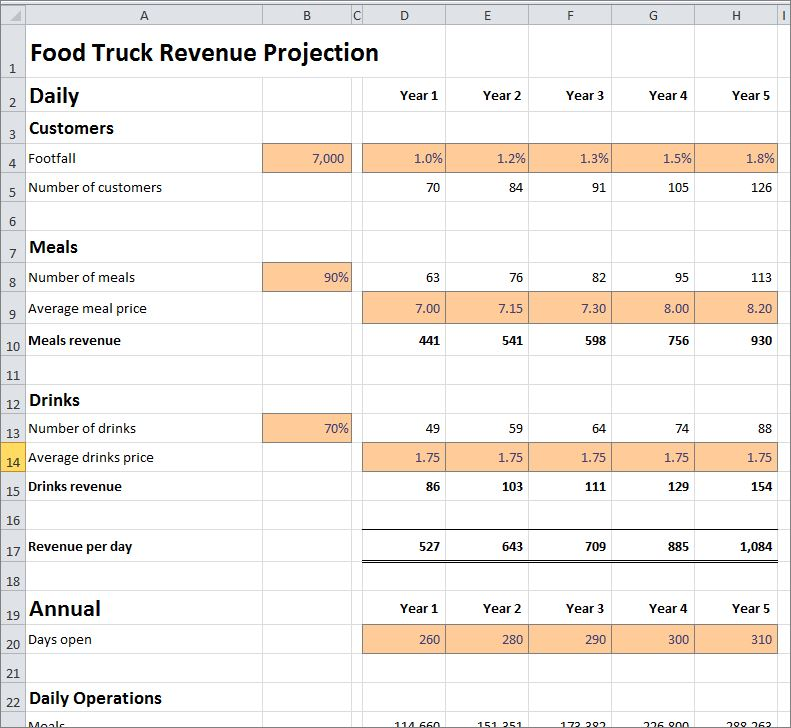

A cash flow forecast can then be derived from the data in your income statement and balance sheets.ĭocuments showing your business forecasts are called pro forma financial statements. Forecasting can be done for a business’s income statements and balance sheets.

The three financial statements can be looked at holistically to understand the overall financial health of your business. There are three fundamental financial statements that small businesses typically issue: income statements, balance sheets and cash flow statements. Small businesses forecast financial statements by looking at relevant historical data and using the information to make future predictions about the financial state of the company. If you need income tax advice please contact an accountant in your area. NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. Here are the main financial forecasting topics covered below: Preparing financial statement forecasts helps small businesses plan their future growth and manage cash flow. Small businesses perform financial forecasting by analyzing historical data and using it to predict the company’s future financial performance.

0 kommentar(er)

0 kommentar(er)